Secure Dwolla and Plaid integration enabling verified bank linking and ACH transfers for eTrustFundBaby.com, with full compliance and smooth onboarding.

Dwolla provides a platform for businesses to integrate bank payments into their applications. It enables users to send, receive, and manage funds directly from bank accounts using the Automated Clearing House (ACH) network.

Plaid provides APIs to connect applications with users’ bank accounts and financial data. Its platform enables businesses to access a wide range of financial information, including account balances, transaction histories, and identity verification, to power services like payments, lending, and budgeting.

Overview

For eTrustFundBaby.com, I implemented a secure bank-to-bank transfer system that lets parents link their bank accounts, add child accounts, and receive contributions from family and friends.

The platform allows parents to request monetary gifts for special occasions, with funds deposited directly into their children’s designated bank accounts.

Project Details

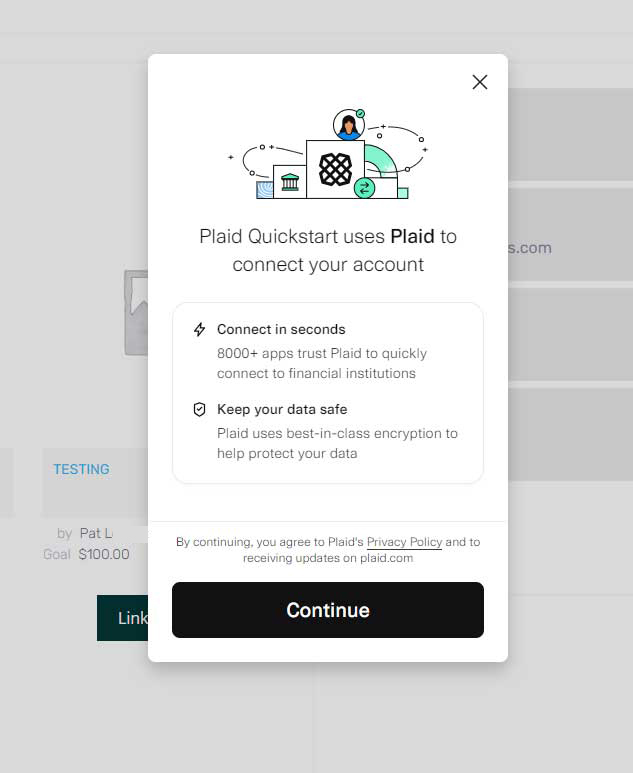

Plaid Bank Account Linking

To simplify onboarding and ensure secure verification, I integrated Plaid so users could connect their bank accounts through a familiar, trusted interface.

Plaid handled:

- Account authentication

- Routing/account number retrieval

- Secure handoff of verified user banking data

This eliminated the need for manual entry and greatly reduced input errors and failed transfers.

Dwolla Money Transfer Integration

Once users connected their bank accounts via Plaid, the system used Dwolla to create customer records and enable ACH transfers between parent and child accounts.

My work included:

- Creating Dwolla Verified Customers

- Handling Dwolla’s compliance and KYC onboarding flow

- Linking Plaid-verified accounts to Dwolla customers

- Initiating and tracking ACH transfers

- Implementing required webhooks for transfer status updates

- Passing Dwolla’s developer review for security and integration accuracy

Dwolla’s onboarding and compliance process is known to be strict — the custom integration met all requirements on the first pass.

Result

A secure, frictionless way for families to transfer money to children’s bank accounts, powered by verified financial connections and ACH transfers.

The integration reduced onboarding friction, ensured compliance with Dwolla’s KYC requirements, and provided a stable foundation for a real-money financial platform.

Tech Stack

- Dwolla API (ACH transfers, verified customers, webhooks)

- Plaid API (account verification & bank linking)

- PHP

- WordPress integration

- Secure customer data workflow